How we fund education in Washington is unconstitutional. It’s not the amount of money we spend on Education that is the problem, it is how the money is appropriated. Today public education is the last to be funded, with the decision often being taken to the voters. The result is that children in poor or otherwise tax unfriendly school districts receive a lower quality education than their peers who are able to attend better funded schools.

Our budget priorities are backwards. There are only a few things called out as being required duties of the state. They are as follows:

- Education

- Reformatory and penal institutions

- Institutions for disabled youth, mentally ill or developmentally disabled

- Courts

- Elections

- Board of Health and Vital Statistics

- Department of Agriculture

- Reserve fund

With the exception of education, all of these required expenditures are funded entirely by the state. Education is different. Only 70% of education is funded by the state. Our schools are left to pay for the remaining 30% through local taxes or federal grants. This means that schools are constantly begging local voters to pay for their operations. Our children are being used to guilt us into paying higher taxes. Education should be fully funded through state dollars. Unfortunately this is easier said than done, since it will add approximately $4.3 billion per year to the state budget. Something has to give!

Washington tax payers are already funding $3.7 billion of that amount through the local tax levy. This is where the “levy swap” model comes in. We could just eliminate all the local taxes and raise the state property tax by lowest local tax rate, but there are 11 school districts that collect no local taxes. In practice, the rates and revenue vary significantly depending on the local property values and willingness to approve taxes. For example, Burien (the Highline School District) pays twice the tax rate that Seattle does to fund their local schools. Under an levy swap, both Seattle and Vashon would see their taxes rise while Burien would see their tax payments decrease.

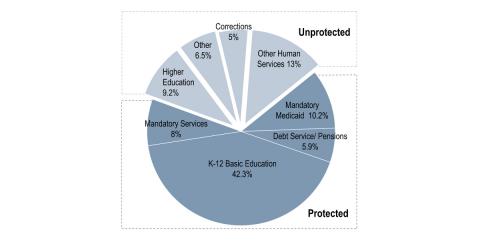

What we need to do is swap the funding of discretionary social and human services with education. Most of these programs live in the agency known as DSHS, but there is a whole host of agencies at the state level. About half of those programs are constitutional duties of the state, but a large portion of them are not. We need to cut just 3.5% and move another 20% of those programs out of state government.

We could pay for the full cost of education at the state level, but we’ve chosen to spend the money elsewhere and use our children to guilt voters into paying for the difference. Let’s fund education first instead of gambling with our children’s future!